Estate Administration

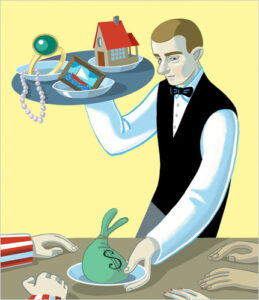

When a loved one dies, it can be a very stressful and emotional time. Many people find themselves in a position they have never been in before and do not know where to begin. This can add to the stress they feel. At ACL-Law we can elevate some of this stress and burden from you by providing clear and concise advice to you, whether you are a beneficiary of the Estate or you have been appointed as an Executor.

Let us take some of the burden of sorting out the Estate or protecting your rights as a beneficiary during this troubling time, so you can focus on grieving for your loved one properly.

Below is a short rundown on the types of matters ACL-Law can assist you with:

Three of the most common complaints from beneficiaries (whether derived from the deceased’s Will or from law) during an Estate Administration are:

Three of the most common complaints from beneficiaries (whether derived from the deceased’s Will or from law) during an Estate Administration are:

1. The Executor / Administrator is withholding a copy of the Will from them;

2. Information is being withheld from them or they are not being regularly updated as to the progress of the Estate Administration. A common comment from beneficiaries is that they ‘do not know what is happening’. The lack of information and communication between the Executor/Administrator and beneficiaries tends to escalate the level of stress and anxiety the beneficiary feels and creates a lot of unnecessary tension on the Executor / beneficiary relationship; and

3. The amount of time the Estate is taking to be administered.

Beneficiaries have certain rights which are protected by law. Unfortunately, not all Executors/Administrators appear to appreciate the beneficiaries’ protected rights and often violate them. One of the beneficiaries’ fundamental rights is to the “due administration of the Estate”. This is the right to make the Executor/Administrator undertake the administration of the Estate properly and in a timely manner.

If you have been named as a beneficiary of a Will or at law, call us today to discuss how we can ensure your rights are protected.

When a superannuation fund member dies, the fund must pay the deceased’s superannuation death benefit, including an insured lump sum, to an eligible recipient. An eligible recipient of a superannuation death benefit includes a dependent on the deceased, or someone who was otherwise in a close personal relationship with the deceased or to the deceased’s Estate.

When a superannuation fund member dies, the fund must pay the deceased’s superannuation death benefit, including an insured lump sum, to an eligible recipient. An eligible recipient of a superannuation death benefit includes a dependent on the deceased, or someone who was otherwise in a close personal relationship with the deceased or to the deceased’s Estate.

Many superannuation funds allow members to nominate who to pay the superannuation death benefit to upon their death. Where there is no valid death benefit nomination, it is up to the trustee of the superannuation fund to decide to whom to pay the death benefit to (although the decision is limited to the class of eligible recipients). If an eligible claimant is unhappy with the trustee’s decisions, they can lodge an objection to the decision. Therefore, it is extremely important to ensure that as part of your Estate Planning, your superannuation death benefit nomination is up to date and is valid to prevent your superannuation death benefit being paid to someone whom you do not wish.

At ACL-Law, we can examine whether you are an eligible claimant for the deceased’s superannuation death benefits. If you are an eligible claimant, to ensure that you receive your full entitlements from the deceased’s superannuation, we can assist you with:

- compiling an application claiming a superannuation death benefit;

- liaising with the trustee of the superannuation fund on your behalf as a claimant or as an Executor/Administrator or beneficiary of the Estate;

- liaising with the trustee of the superannuation fund if there is an objection lodged; and

- liaising with AFCA (Australian Financial Complaints Authority) if an appeal is lodged.Call us today to discuss how we can assist you make a claim for the superannuation death benefit.

Administrating a deceased Estate is a very involved process which has a number of steps that must be undertaken before the ‘Estate Administration’ can be classified as having been completed.

Administrating a deceased Estate is a very involved process which has a number of steps that must be undertaken before the ‘Estate Administration’ can be classified as having been completed.

Estate Administration essentially is the process undertaken by the Executor or the Administrator to:

- Identify and locate beneficiaries in accordance with the Will or to law;

- Identify collect and pay the deceased’s liabilities from the deceased’s assets (where sufficient);

- Obtain a Grant of Probate or Letters of Administration from the Supreme Court;

- Identify, collect and distribute the deceased’s assets to the beneficiaries;

- Defend any litigation brought against the Estate; and

- Attend to the taxation affairs of the deceased.

Administering an Estate can be time consuming and lengthy process depending on things like, the assets and liabilities involved, if there is any Estate litigation brought and the dealings with the beneficiaries (i.e. how easy the beneficiaries are to locate, the number of beneficiaries, the types of gifts, the Executor/beneficiary relationship or beneficiary/beneficiary relationship (e.g. a strained relationship with a lot of friction/disputes will usually result in increased delays in the Estate Administration) etc).

Given the complexity involved it is important that you have someone who is able to walk you through the legal mind field that is Estate Administration. Call us today to see how we can assist you in administrating the Estate.

Whilst the Executor has a right at law to make a claim to be compensated for their ‘pains and troubles’, there is no automatic entitlement and not every Executor actually receives remuneration for their role in the Estate Administration.

Executors Commission is the remuneration of the Executor for their services (‘pains and troubles’) in administering the Estate. Executor’s Commission is paid upon the nature of the services (tasks) performed and the responsibility for their care and maintenance of assets during the Estate Administration. Essentially the amount of Executor’s Commission paid will be dependent upon the pains and troubles of the Executor.

Call us today to discuss whether you could make a claim for Executor’s Commission and what is involved in the process.

Whilst the Executor has a right at law to make a claim to be compensated for their ‘pains and troubles’, there is no automatic entitlement and not every Executor actually receives remuneration for their role in the Estate Administration.

Executors Commission is the remuneration of the Executor for their services (‘pains and troubles’) in administering the Estate. Executor’s Commission is paid upon the nature of the services (tasks) performed and the responsibility for their care and maintenance of assets during the Estate Administration. Essentially the amount of Executor’s Commission paid will be dependent upon the pains and troubles of the Executor.

Call us today to discuss whether you could make a claim for Executor’s Commission and what is involved in the process.

Probate involves making an application to the Supreme Court to prove and register the last Will of a deceased person. When a person dies, somebody has to deal with their Estate. It is usually the Executor of their Will who administers the Estate and handles the disposal of the deceased’s assets and payment of their debts. In order to get authority to do this, the Executor usually need to obtain a legal document called a ‘Grant of Probate’.

Probate involves making an application to the Supreme Court to prove and register the last Will of a deceased person. When a person dies, somebody has to deal with their Estate. It is usually the Executor of their Will who administers the Estate and handles the disposal of the deceased’s assets and payment of their debts. In order to get authority to do this, the Executor usually need to obtain a legal document called a ‘Grant of Probate’.

In circumstances where there is either no last Will or there is an issue with the Will (i.e. the Executor has died / refuses to accept the position and someone else has to be appointed as an alternate), then Letters of Administration will need to be obtained from the Supreme Court. This is an alternative to obtaining Probate and can be a complex and a legally technical process. Letters of Administration allows the administrator(s) to manage and distribute the deceased’s assets. Until Letters of Administration has been obtained, no one has the authority to appropriately deal with the deceased’s Estate.

In Queensland, where there is a valid last Will, not all Estates require a Grant of Probate to be obtained from the Supreme Court, it is largely determined by the type of Estate assets and the value of the assets. Where there is no valid last Will or there is no Executor, however, then Letters of Administration must be obtained before the Estate can be administered. In New South Wales on the other hand, obtaining either a Grant of Probate or Letters of Administration is mandatory, regardless of the types of Estate assets or their value.

Call us today to discuss your particular situation and whether a Grant of Probate or Letters of Administration is required.

Under a joint ownership of property or assets, if one joint owner dies, the interest in the property or asset held by the deceased immediately passes to the surviving joint owner/s pursuant to the rules of survivorship (not on the basis of the provisions in the deceased’s Will).

Under a joint ownership of property or assets, if one joint owner dies, the interest in the property or asset held by the deceased immediately passes to the surviving joint owner/s pursuant to the rules of survivorship (not on the basis of the provisions in the deceased’s Will).

The title of the property/assets must be formally changed and the Land Title Registry or the asset holder (e.g. a bank or share registry) must be formally notified of the deceased’s death. This often involves complex applications or numerous forms which need to be completed correctly. Unfortunately, unless the forms are completed correctly and all supporting information / documentation is provided, the Land Title Registry or the asset holder will not record the deceased’s death and their name will not be removed from the property title or asset.

Call us today to discuss how we can elevate the burden of ensuring the correct forms, information and documentation are provided to the Land Title Registry and/or the asset holder, so the decease’s death is recorded and the title of the asset vests in the surviving joint owner/s.